Search

Educational Improvement Tax Credit Program

-

-

Support for Catholic Education

Donations provide scholarships for eligible students, helping families afford values-based Catholic schooling.

Tax Credit Benefits

Participants receive a 90% PA tax credit with a two-year commitment for choosing to redirect their PA tax liability to Catholic education.

Donor Flexibility

Donors choose the benefiting Diocesan Catholic school or allow those funds to address greatest family tuition assistance needs.

Simple Participation Process

Our streamlined process involves a pledge form, 2-page LLC joinder agreement, and contribution to a scholarship fund.

Pledge Participation Now or Talk to an Expert.

-

-

-

.

-

-

-

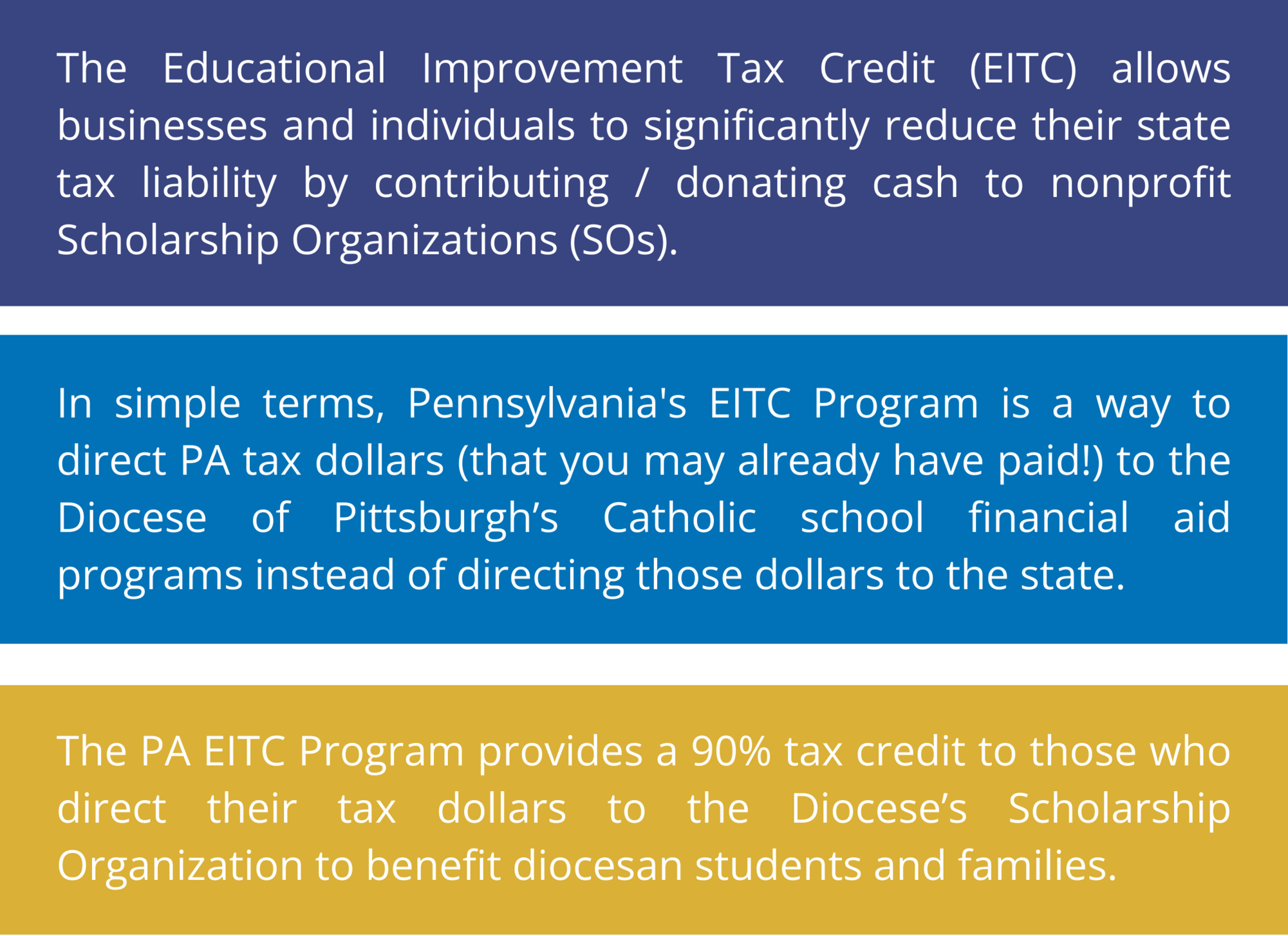

What is the EITC Program?

-

Ways to Participate:Individuals and businesses can become a donor by participating as a member of one of our SPEs (Scholastic Opportunity Scholarship Fund LLCs).

Businesses donate by obtaining their own tax credits through the PA DCED website; and, once approved, donating to the Scholastic Opportunity Scholarship SO.

For businesses who want to directly obtain your own tax credits, please contact us for support.

-

-

-

Simple Steps for Big ImpactHow it Works:Step 1: Pledge

Complete the short pledge form to start the process.

Step 2: Sign

Sign the LLC Agreement (we’ll guide you through it).

Step 3: Contribute

Once directed, send your contributions to the LLC for Scholastic Opportunity Scholarships.

Step 4: File

Receive your K-1 Forms and file your PA taxes to receive your 90% state tax credit.

Step 5: Repeat

Renew (every 2 years) and continue providing tuition assistance to eligible families.

-

-

Commonly Asked Questions

- Why give through the Diocese of Pittsburgh's EITC scholarship program?

- Can I choose which school receives my scholarship donation?

- Can I direct my scholarship donation to a specific child?

- What percentage of my contribution goes to the scholarships?

- Who is eligible to participate in this program and receive individual tax credits?

- What types of taxes can be offset by this credit?

-

Why give through the Diocese of Pittsburgh's EITC scholarship program?Working with the diocese keeps your tax-credit dollars serving Catholic families right here at home. We make participation simple for individuals and businesses through our diocesan Special Purpose Entities (SPEs), provide hands-on guidance, and steward funds with transparent compliance, all in direct support of Catholic education and student faith formation in our communities. While other organizations may solicit EITC contributions, directing your gift through the diocese ensures it stays local and is managed by the people who know our schools best.

-

Can I choose which school receives my scholarship donation?You can choose a specific diocesan Catholic high school or Catholic elementary school/region. You can also choose NOT to designate, which allows your donation to go to those with the greatest need.

-

Can I direct my scholarship donation to a specific child?No, scholarships are directed to schools and are awarded to eligible families. Eligibility is income-based per PA state guidelines.

-

What percentage of my contribution goes to the scholarships?If you donate through us, we guarantee that 100% of your contribution goes toward the school grouping of your choice.

-

Who is eligible to participate in this program and receive individual tax credits?Both businesses and individuals can choose to participate in this program (must have at least $2,000+ in PA tax liability).

Businesses and individuals can take advantage of this tax-credit program through becoming a member of a Scholastic Opportunity Scholarship LLC (LLC). These Special Purpose Entities (SPE’s) are the only financial vehicle available for individuals (or companies who do not have direct tax credit approval) to be able to realize tax credits in return for scholarship donations.

To join, individuals or companies must meet the following criteria:- A 2-consecutive-year commitment to participate and contribute

- Ability to meet a minimum annual contribution amount of $2,000

-

What types of taxes can be offset by this credit?Businesses that are authorized to do business in Pennsylvania who are

subject to one or more of the following taxes:- Corporate Net Income Tax

- Capital Stock/Foreign Franchise Tax

- Malt Beverage Tax

- Personal Income Tax --- Sub-chapter S-corporations and other “pass-through” entities will be able to use the credit against the shareholders’, members’, or partners’ PA personal income taxes

- Bank and Trust Company Shares Tax

- Insurance Premiums Tax (excluding surplus lines, unauthorized, domestic/foreign marine)

- Mutual Thrift Institutions Tax

- Title Insurance Companies Shares Tax

- Retaliatory Fees under Section 212 of the Insurance Company Law of 1921

-

-

Federal Tax Credit OpportunityProgram Timeline

The program begins in 2027, allowing taxpayers to plan for future tax credit opportunities effectively.

Full Federal Tax Credit

Taxpayers can redirect 100% of federal tax liability up to $1,700, significantly reducing net contribution costs.

Support for Catholic Education

Redirected tax credits directly support Catholic schools, reinforcing community and faith-based educational missions.

Click here to learn more

-

-

-

Contact and Support

-

Michael D. Frekermfrekerdiopitt.orgDirector of Planned Giving

-

Anthony L. Novellianovellidiopitt.orgDirector of EITC/OSTC Services

-

-

Already participating? Please share this opportunity with other business owners and individuals who may be eligible.

Thank you for supporting Catholic education through EITC.

-

-

Prayer of Thanksgiving for EITC Donors

-

Heavenly Father,We thank You for the generous hearts of those who give so that children may receive a Catholic education. Bless them for their kindness and sacrifice.May the students who benefit from these scholarships grow in wisdom, faith, and love, and may they carry the light of Christ to the world.Strengthen our schools, inspire our donors, and guide us in continuing this mission to make Catholic education accessible to all.We ask this through Christ our Lord.Amen.

-